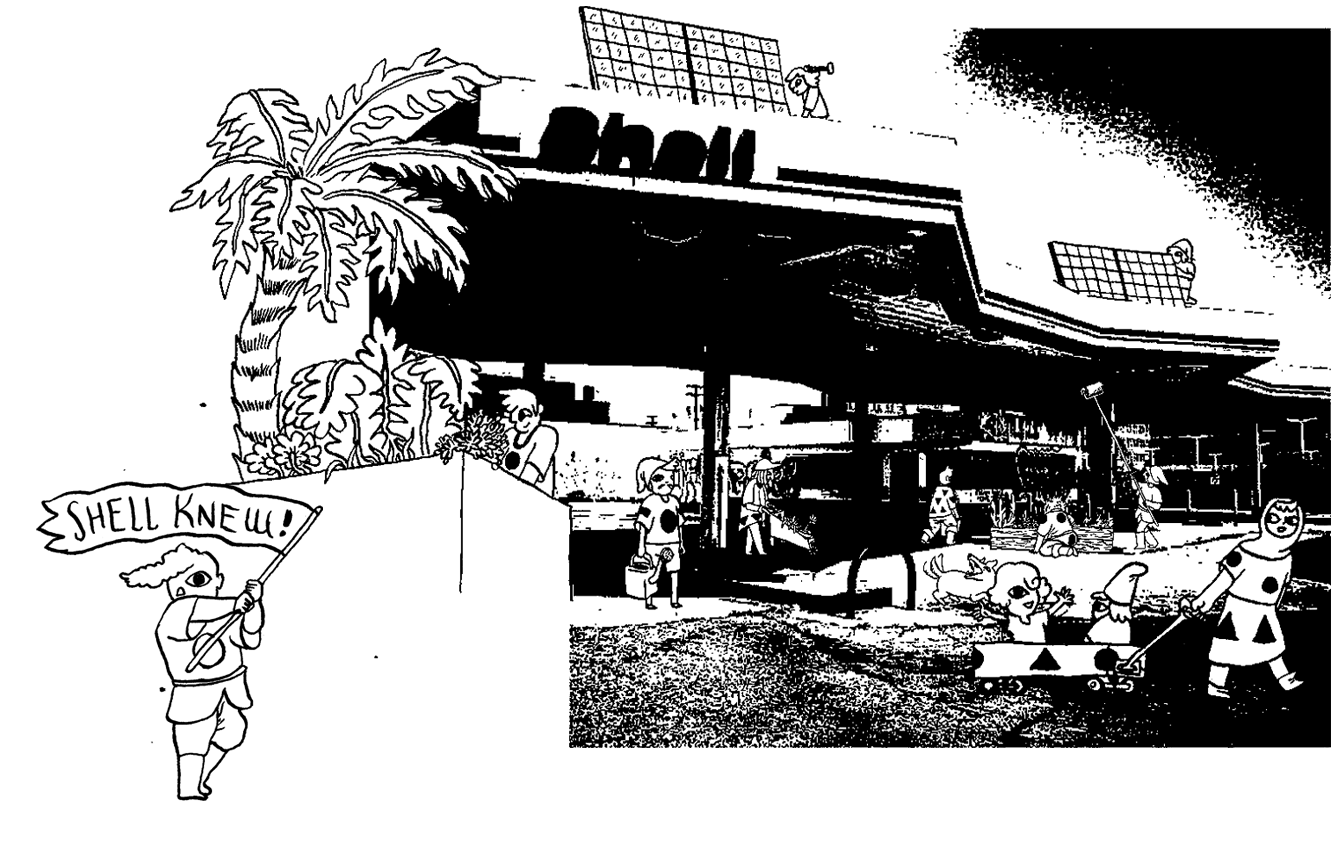

Colonialism, ruthless financialisation, and insidious tactics designed to obscure the truth and hold onto power; a breakdown of how Shell has accumulated power and profit, and why it cannot be part of a just energy transition.

This second episode in our two-part series on Putin’s war on Ukraine and oil and gas tackles three big issues. First, it looks at the relationship between revenues from fossil fuel exports and Russia’s attack on Ukraine; second, the challenges and pay-offs of divestment from and embargoes of Russian oil and gas, and third, what possibilities for a future beyond fossil fuels the situation opens up. How might we set up an energy system that allows us to condemn war and incursions on sovereignty and promotes peace?

Suing, taxing, regulating, nationalising, bankrupting; what are the pathways to a Future Beyond Shell? Sign up for the podcasts series —launching in April— to explore how multinationals like Shell could, and eventually will, meet their end.

Shell has consistently supported carbon emissions trading and, in certain areas of the world, carbon taxes. Beyond carbon capture and nature-based solutions, it promotes reliance on carbon markets as a core climate action strategy that is in line with their business goals. But how successful have these neoliberal tools really been in moving us towards an anti-colonial and anti-capitalist future? Can some of their inefficiencies be resolved by tweaking market rules or is the idea of carbon pricing simply doomed to fail based on an inherently flawed logic?

There are a number of pathways to nationalization. In Shell's case, as a British and Dutch-owned company, we will explore where such a nationalization might take place, and a few of the mechanisms, as well as various implications of public ownership. Would a nationalization mitigate global warming to 1.5C, as outlined in the Paris Agreement? How can we ensure we actually wind Shell down once we take it into public ownership? How might nationalization support fossil fuel workers in a transition?

An in-depth analysis of Shell’s financialisation reveals how they have maximised profit at any expense. Creative tax structures, dividend and share gymnastics, strategic debt and asset accumulation; read how Shell became the archetype neoliberal multinational.

Oil interests are deeply entrenched in colonial history, and benefit from the colonial dynamics that persist today. The following article unpacks Indonesia’s history of oil, colonialism and local resistance, not only revealing Shell’s complicity, but also its direct interests in colonial violence.

In this first episode of a two-part series on Putin’s war on Ukraine and oil and gas, we focus on Shell’s business prospects and what room there is to wind Shell down. First, we ask, what does Shell’s and other fossil fuel companies’ exit from Russia mean for Shell economically and for the future of its business? Second, can such an exit somehow contribute towards a just energy transition?

In order to identify and assess the tools it may take to dismantle a corporation like Shell, we first need a good understanding of how the company operates in the context of the global political economy. What tactics have helped Shell to become the powerful oil and gas major it is today and which ones is it likely to pursue in future?

In this episode, we will discuss the role of court cases and strategic litigation as tactics to counter the power of fossil fuel companies at large, and Shell in particular. How effective is litigation in actually holding fossil fuel companies accountable and preventing disastrous climate breakdown? Can they account for the international nature of Shell and its contributions to global emissions? Are court cases a key tool to move towards a Future Beyond Shell?

Get ready for the 9th of November when we will be launching the first season of the Future Beyond Shell podcast! Shell has long been impeding any hope of a Just Transition from the fossil fuel age, making an end to Shell necessary, overdue and inevitable. But what are the pathways to a Future Beyond […]

The Energy Charter Treaty is the fossil fuel industry's legal enforcement lobby outside all national sovereignty and democratic accountability. Can we really talk about a just energy transition while instruments like ECT and ISDS are still operational?

How will (Royal Dutch) Shell infrastructure across the world will be decommissioned and repurposed over the coming decades, following just transition principles? This special report proposes some pathways.

In this episode, we’ll talk about the fact that Shell moved its headquarters to the UK in January 2022. The biggest change that this shift of headquarters brings is that the fiscal residency of the company will move from the Netherlands to the UK.

In this episode, we will explore lessons from past bankruptcies in the fossil fuel sector, and what they might mean for Shell. While most people agree that Shell is not currently close to filing bankruptcy, bold climate policy and emissions targets set by governments might bring Shell closer to the edge. This is how we arrive at the question, would letting Shell go bankrupt be a reasonable strategy? Could letting big polluters go bankrupt finally facilitate a Just Transition away from fossil fuels? Or will they simply leave workers and impacted communities to fend for themselves in the midst of abandoned fossil infrastructure?

In this episode, we will continue our conversation on the role of strategic litigation as a tactic to counter the power of fossil fuel companies at large, and Shell in particular. How effective is litigation in actually holding fossil fuel companies accountable, in terms of historical environmental injustices like pollution in Ogoniland in Nigeria, and in terms of shifting power to oppressed, often racialized communities? Are court cases generally 'too little, too late,' or do they have genuinely transformative power? Are they a key tool to move towards a Future Beyond Shell?

How can energy be owned, managed, and produced in a way that is just, clean and affordable? Principles to root ourselves in and pioneering examples from around the world pave the way towards a Future Beyond Shell and the injustice it represents.

As the fossil free movement gains traction, Shell and other multinationals are increasingly concerned about their public image. Elaborate marketing and advertising campaigns are used to cover the dirty truth with a green coating.

We have received the following obituary about Shell’s demise, from an author reaching us from the future. Reluctant to disrupt the arc of history bending towards justice, we are publishing it unredacted.

How will (Royal Dutch) Shell infrastructure across the world will be decommissioned and repurposed over the coming decades, following just transition principles? This special report proposes some pathways.

This second episode in our two-part series on Putin’s war on Ukraine and oil and gas tackles three big issues. First, it looks at the relationship between revenues from fossil fuel exports and Russia’s attack on Ukraine; second, the challenges and pay-offs of divestment from and embargoes of Russian oil and gas, and third, what possibilities for a future beyond fossil fuels the situation opens up. How might we set up an energy system that allows us to condemn war and incursions on sovereignty and promotes peace?

In this first episode of a two-part series on Putin’s war on Ukraine and oil and gas, we focus on Shell’s business prospects and what room there is to wind Shell down. First, we ask, what does Shell’s and other fossil fuel companies’ exit from Russia mean for Shell economically and for the future of its business? Second, can such an exit somehow contribute towards a just energy transition?

In this episode, we’ll talk about the fact that Shell moved its headquarters to the UK in January 2022. The biggest change that this shift of headquarters brings is that the fiscal residency of the company will move from the Netherlands to the UK.

Suing, taxing, regulating, nationalising, bankrupting; what are the pathways to a Future Beyond Shell? Sign up for the podcasts series —launching in April— to explore how multinationals like Shell could, and eventually will, meet their end.

In order to identify and assess the tools it may take to dismantle a corporation like Shell, we first need a good understanding of how the company operates in the context of the global political economy. What tactics have helped Shell to become the powerful oil and gas major it is today and which ones is it likely to pursue in future?

In this episode, we will explore lessons from past bankruptcies in the fossil fuel sector, and what they might mean for Shell. While most people agree that Shell is not currently close to filing bankruptcy, bold climate policy and emissions targets set by governments might bring Shell closer to the edge. This is how we arrive at the question, would letting Shell go bankrupt be a reasonable strategy? Could letting big polluters go bankrupt finally facilitate a Just Transition away from fossil fuels? Or will they simply leave workers and impacted communities to fend for themselves in the midst of abandoned fossil infrastructure?

Shell has consistently supported carbon emissions trading and, in certain areas of the world, carbon taxes. Beyond carbon capture and nature-based solutions, it promotes reliance on carbon markets as a core climate action strategy that is in line with their business goals. But how successful have these neoliberal tools really been in moving us towards an anti-colonial and anti-capitalist future? Can some of their inefficiencies be resolved by tweaking market rules or is the idea of carbon pricing simply doomed to fail based on an inherently flawed logic?

In this episode, we will discuss the role of court cases and strategic litigation as tactics to counter the power of fossil fuel companies at large, and Shell in particular. How effective is litigation in actually holding fossil fuel companies accountable and preventing disastrous climate breakdown? Can they account for the international nature of Shell and its contributions to global emissions? Are court cases a key tool to move towards a Future Beyond Shell?

In this episode, we will continue our conversation on the role of strategic litigation as a tactic to counter the power of fossil fuel companies at large, and Shell in particular. How effective is litigation in actually holding fossil fuel companies accountable, in terms of historical environmental injustices like pollution in Ogoniland in Nigeria, and in terms of shifting power to oppressed, often racialized communities? Are court cases generally 'too little, too late,' or do they have genuinely transformative power? Are they a key tool to move towards a Future Beyond Shell?

There are a number of pathways to nationalization. In Shell's case, as a British and Dutch-owned company, we will explore where such a nationalization might take place, and a few of the mechanisms, as well as various implications of public ownership. Would a nationalization mitigate global warming to 1.5C, as outlined in the Paris Agreement? How can we ensure we actually wind Shell down once we take it into public ownership? How might nationalization support fossil fuel workers in a transition?

Get ready for the 9th of November when we will be launching the first season of the Future Beyond Shell podcast! Shell has long been impeding any hope of a Just Transition from the fossil fuel age, making an end to Shell necessary, overdue and inevitable. But what are the pathways to a Future Beyond […]

How can energy be owned, managed, and produced in a way that is just, clean and affordable? Principles to root ourselves in and pioneering examples from around the world pave the way towards a Future Beyond Shell and the injustice it represents.

An in-depth analysis of Shell’s financialisation reveals how they have maximised profit at any expense. Creative tax structures, dividend and share gymnastics, strategic debt and asset accumulation; read how Shell became the archetype neoliberal multinational.

The Energy Charter Treaty is the fossil fuel industry's legal enforcement lobby outside all national sovereignty and democratic accountability. Can we really talk about a just energy transition while instruments like ECT and ISDS are still operational?

As the fossil free movement gains traction, Shell and other multinationals are increasingly concerned about their public image. Elaborate marketing and advertising campaigns are used to cover the dirty truth with a green coating.

Oil interests are deeply entrenched in colonial history, and benefit from the colonial dynamics that persist today. The following article unpacks Indonesia’s history of oil, colonialism and local resistance, not only revealing Shell’s complicity, but also its direct interests in colonial violence.

We have received the following obituary about Shell’s demise, from an author reaching us from the future. Reluctant to disrupt the arc of history bending towards justice, we are publishing it unredacted.